Low Income Threshold 2025. Reduce the 32.5 per cent tax rate to 30 per cent. From 1 july 2025, the proposed tax cuts will:

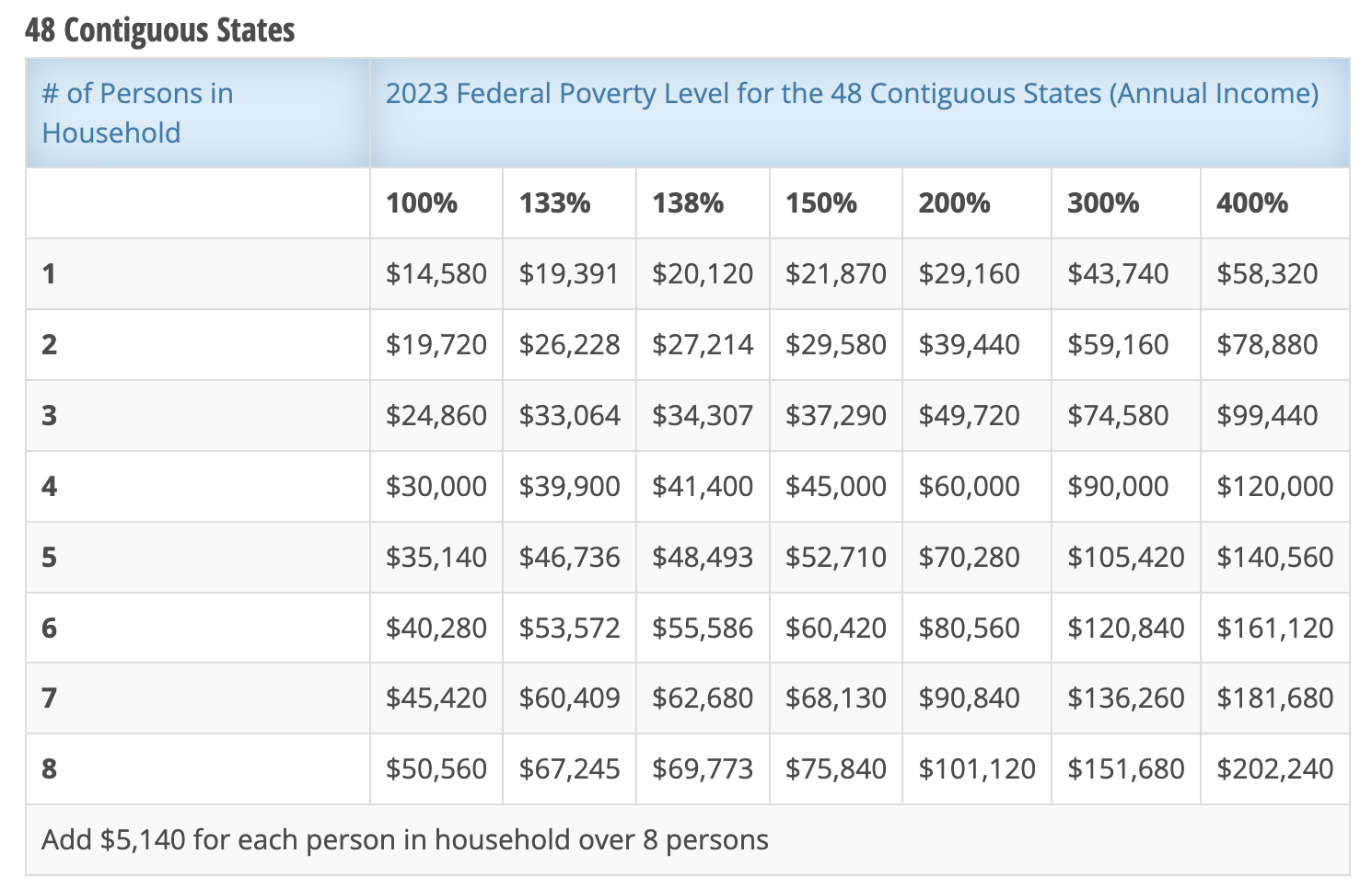

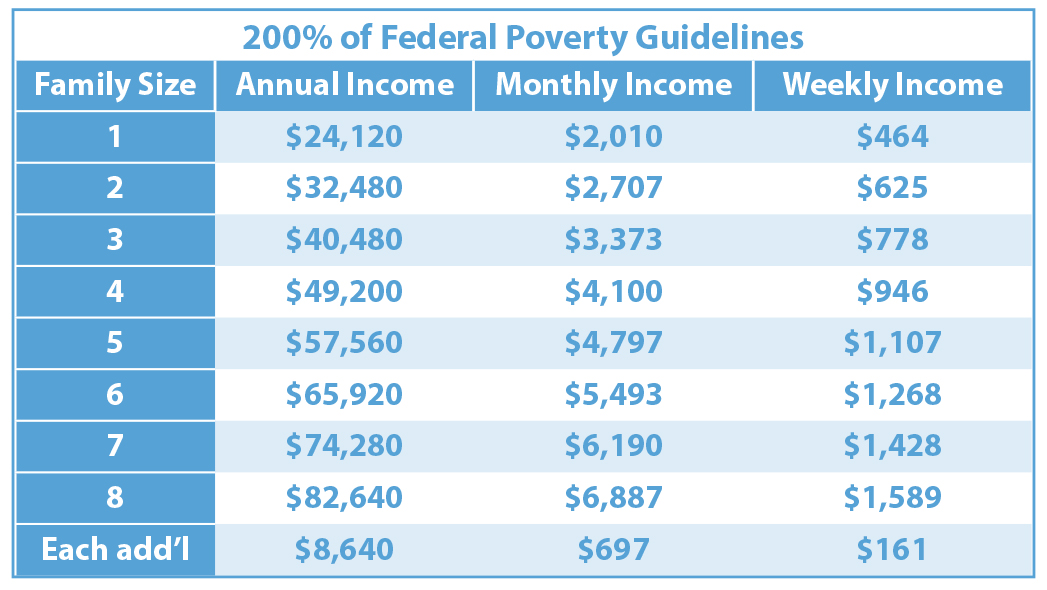

In 2025 hhs has set the federal poverty level for all contiguous 48 states, puerto rico, the district of columbia and all u.s.

USCIS Federal Poverty Guidelines for 2025 Immigration Updated, In 2025 hhs has set the federal poverty level for all contiguous 48 states, puerto rico, the district of columbia and all u.s. 50% to 80% of ami;

What Is Poverty Level INVOMERT, Your situation your annual income must be maximum monthly payment amount; 50% to 80% of ami;

Maximize Your Paycheck Understanding FICA Tax in 2025, Why not the mean average? A threshold for low income is used for comparing sections of the income distribution over time.

How do families with low spend their money? Econofact (2025), The term may also be used to mean 0% to 80% of ami. How much of your income is above your personal allowance;

2025 Tax Brackets The Best To Live A Great Life, Why not the mean average? For individual claimants, the aet is £677 per.

Federal Budget 202324 Personal tax Pitcher Partners, Filing statuses have different income thresholds, so individuals may. The current tax year is from 6 april 2025 to 5.

Ss Earning Limit 2025 Beryle Leonore, Reduce the 32.5 per cent tax rate to 30 per cent. The current tax year is from 6 april 2025 to 5.

2025 Federal Poverty Level Chart Pdf, The federal income tax has seven tax rates in 2025: Reduce the 32.5 per cent tax rate to 30 per cent.

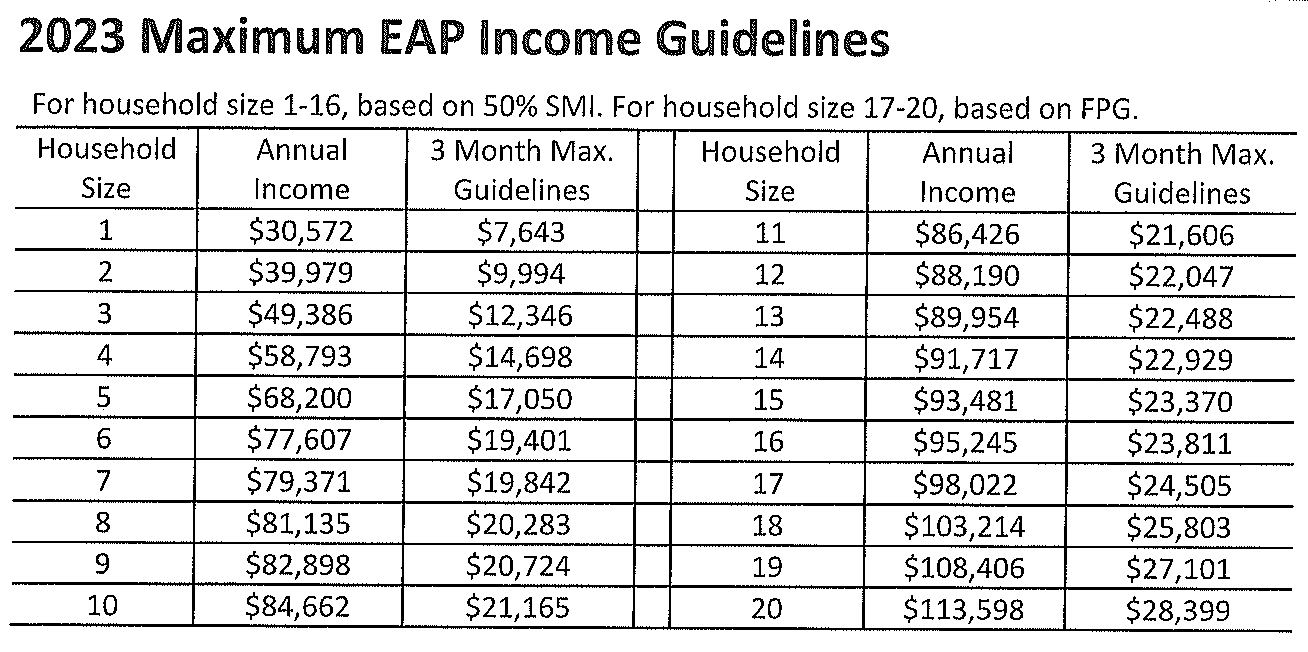

Energy Assistance Guidelines TriValley Opportunity, People need to see if their gross income is over the required filing threshold. I am single, divorced or widowed:

T140048 Eliminate Threshold for the Refundable Child Tax, The 32.5% marginal tax rate will be lowered to 30% for a substantial bracket spanning from $45,000 to. For tax returns filed in 2025, the tax credit ranges from $600 to.